Measure Twice,

Cut Once

Only a limited number of LOHAS clients are well suited for a crowdfunding campaign, but for select organizations it can be an intelligent strategy for raising capital or simply enhancing customer engagement. For these companies, crowdfunding can also be an ideal supplement to more traditional fundraising approaches or an innovative joint activity with a strategic partner.

Regardless of your motivations, if you are contemplating running a crowdfunding campaign, the LOHAS team has the experience and insight to help craft the overall fundraising strategy as well as support campaign execution.

It Starts with a Plan

Most client engagements begin with a campaign planning session in which a variety of factors are reviewed:

Partner Support

Data Assets

Budget/Timelines

Investor Support

Financial Goals

Marketing Goals

Current Collateral

The planning session results in a LOHAS-generated campaign plan deliverable, which our clients review and, ultimately, approve before the campaign process commences. Per the budget established, LOHAS is paid on a fee-for-service basis, with substantial work performed both prior to and during a campaign.

Alternatively, clients may opt to select from a variety of solutions we offer to enhance aspects of their campaign activities (e.g., Campaign Planning or Influencer Identification and Engagement). Either way, most campaigns should follow a systematic process over a period of months to achieve their financing and marketing objectives.

What We Do

Financing Strategy

We help you navigate through the myriad of new investment regulations and develop an alternative financing strategy that fits your organization from an offering and investor perspective.

Marketing Innovation

We help craft strategies to take full advantage of the fundraising campaign and achieve marketing objectives that will support growth long after the capital goals are met.

Campaign Development

From allocating budgets and establishing timelines to the development of messaging and collateral, we help align campaign activities with the overall financing and marketing objectives.

Influencer Outreach

Data-Driven Marketing

Campaign Execution

Testimonials

Sample Campaign Timeline

Planning to Launch (~90 Days)

Campaign Planning

- Marketing Strategy

Financing Strategy

Budgeting & Timelines

Messaging & Content

- Goals, Targets & Mapping

Videos & Collateral

Ad Copy & PR

Investor Communications

Pre-Launch Marketing

- Influencer ID & Engagement

PR & Market Testing

Pre-Selling Support

Offering Page & Social Media Prep.

Data Evaluation & Strategy

- Client Assets

Partner Assets

LOHAS Assets

Acquisition Plan

Partner Introduction & Management

- Investment Portal

Legal & Accounting

Investor Communications

POST-LAUNCH MARKETING

- PR, Content, & Social Media Management

Inbound/Outbound Analytics & Reporting

Engine Optimization

Launch to Close (~90 Days)

Is Crowdfunding Right for You?

Does your product or service or organizational mission benefit people or planet in some clearly discernable way?

Can others (consumers, donors, or accredited investors) easily understand your offering and its benefits?

Is there a definable constituency or community that really cares about what you do and the results you can achieve?

Why We Do What We Do

Companies outside of traditional investor comfort areas (such as technology, oil and gas, and real estate) have historically had limited options for private capital, adversely impacting the growth prospects for health and sustainability and other social impact ventures. Investment crowdfunding (made possible by the JOBS Act) and other alternative financing approaches have blossomed in recent years, allowing for a democratization of the fundraising process and the creation of innovative, new marketing strategies.

In addition to the market need, due to their emotional appeal, social impact ventures are also better suited for marketing to a broader-based audience (i.e., tapping into investors’ passions). However, whether soliciting accredited or unaccredited investors, accelerating product commercialization, raising donations, or trying to achieve key marketing objectives, most organizations lack the time, tools, and talent to execute a successful crowdfunding or similar alternative financing campaign.

Crowdfunding FAQ

Crowdfunding and other alternative investment strategies are relatively recent paths for raising capital or achieving marketing objectives. While LOHAS receives inquiries from nonprofits and prospective strategic partners regarding leveraging these new financing and marketing approaches, most outreach involves the recent investment crowdfunding regulations and considerations when contemplating the direct sale of investment securities.

The most frequently asked questions related to the “JOBS Act” are addressed below. Many of the campaign strategies discussed below are applicable to others as well, but if you have questions not covered in this area, please contact us and share your specific query.

Basics of the JOBS Act (aka Equity Crowdfunding, Marketplace Investing, or Investment Crowdfunding)

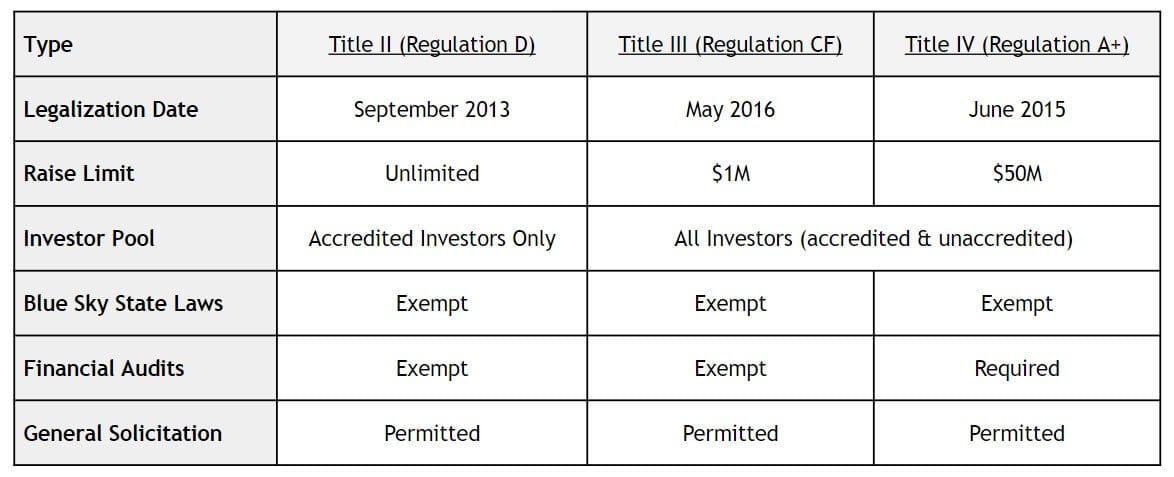

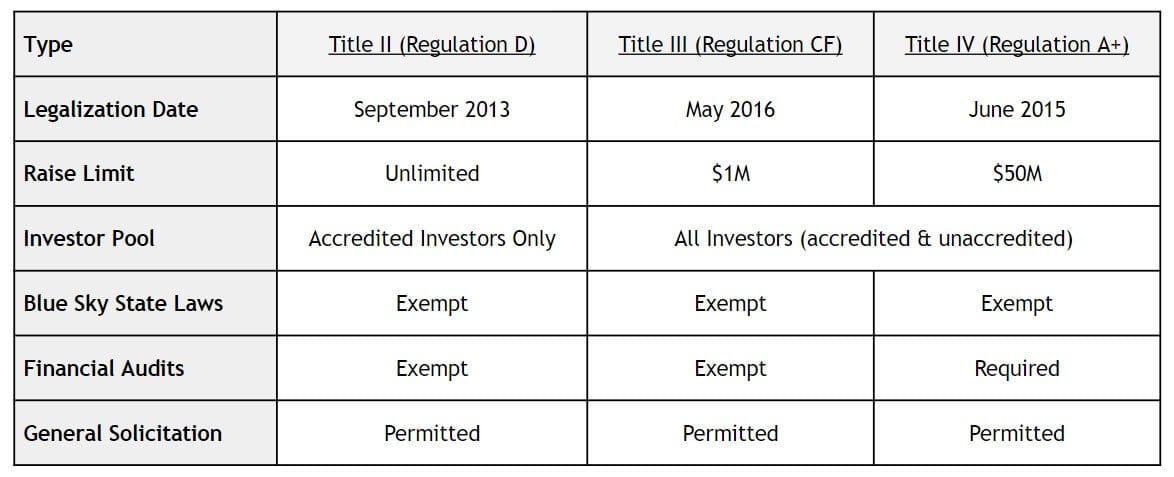

Passed by federal legislation in 2012 and recently amended and implemented, the JOBS Act made two major changes to long-standing U.S. securities laws: 1) opening the door to the participation of unaccredited investors in the direct sale of company securities; and 2) allowing for general solicitation when marketing the sale of such investment opportunities. These were monumental changes, democratizing the investment process for both companies and prospective investors while allowing for sophisticated marketing strategies to identify, reach, and engage potential investors.

Original regulations and terms under the JOBS Act:

Benefits to the Issuing Company

There are a variety of reasons that a company might consider JOBS Act fundraising for some or all of its capital raising needs:

- At a very simple level, a company may be experiencing challenges meeting its capital raising goals (in whole or in part) purely from professional investors perhaps due to the company’s location (i.e., not geographically proximate to investor pools for the stage of investment sought) or area of focus (e.g., traditional venture capital investment favors pure technology companies, not businesses with a positive social impact).

- If executing an equity crowdfunding raise, a company’s valuation during the raise is set by the company and not dictated by outside investors, preserving value for current company shareholders.

- If executing an equity raise, a company can elect to offer only non-voting, common shares versus the preferred shares typically required by professional investors. The company would not have to allocate board seats to the new investors or displace existing investors or board members.

- In promoting its crowdfunding investment campaign, a company is, in essence, investing time and resources in a 2 for 1 by raising awareness and generating demand for the company’s offering while simultaneously seeking capital investment.

- If “friends of the firm” have expressed an interest in investing in a company, but those some of those individuals are not accredited investors, then a campaign open to unaccredited investors may be useful to capture that investment and engage that support.

- If a company has operations or plans to expand into international markets or has founders or a business model connected to those markets, a JOBS Act fundraising campaign can be geared to capture investment from those areas and not just U.S. investors.

- If a company has enjoyed substantial customer adoption but has faced challenges raising additional investment from professional investors and is contemplating closing the company’s doors, then an equity crowdfunding event is a relatively inexpensive way to leverage existing customer engagement by tapping those customers as company investors to sustain the business until it can become self-sustaining (or attract additional investment).

- Similarly, if a company’s solution is in high demand and/or customers have a clear dependency, then engaging those customers in equity crowdfunding may be a perfect fit for capital raising in that it aligns the needs of the buyer with those of the seller. This may be particularly relevant with health solutions that solve (or create an expectation that they may solve) a health or wellness problem. In these scenarios, there are few investors who would be better suited to support the company than those who would most benefit directly or indirectly (e.g., friends or family) from the company’s solution (or potential solution).

- Perhaps the most compelling rationale for marketplace investing is not related to raising capital but rather engaging customers as stakeholders in the company. Once a customer buys a stake in a company, that customer’s relationship with the company is no longer one of vendor-customer but rather a vested stakeholder in the business’s journey. These cornerstone customers can become brand ambassadors and sources of support and testimonials. The marketing departments of consumer product/service companies spend their days trying (often unsuccessfully) to get their customers engaged in their businesses through incentives and persistent outreach. The ironic method of getting customers to promote your business? Allow them to invest money into your business.

- While consumer product/service companies may benefit from selling a sliver of their companies to their customers, even B2B companies pursuing JOBS Act investment from accredited investors may reap rewards from a robust investment campaign by raising company awareness and developing an expanded company ecosystem of partners, suppliers, etc.

- Given the underlying benefits of including a company’s customers, etc. in the business, market analysts expect to start seeing companies pursuing JOBS Act fundraising even if the company does not need investment capital. If a company executes a campaign that generates hundreds of new customers, engages a portion of the new or existing customers as investors/stakeholders in the business’s mission, and raises enough capital to pay for the costs of executing the campaign, most company management teams would consider that a successful operation.

JOBS Act Company Financing Strategies

Perhaps least well understood in the early days of the JOBS Act is how an equity crowdfunding financing can and should be used as a component of a company’s financing strategy. How can this approach work in conjunction with professional investors, and what are those leverage points that crowdfunding can create?

- For a company expanding into new geographical markets, an equity crowdfunding campaign can serve as a market entry announcement and provide financial support for market expansion activities. A campaign provides a path for new market customers to invest in the future of the business and become the cornerstone supporters in that new geography and can be targeted to reach individuals only in that area.

- Most companies pursuing an equity crowdfunding financing do not see it as a panacea for all capital needs but rather a tool in their financing toolbox to be used in conjunction with professional investment. When and how should such investment be engaged in the process?

- Ideally, professional investment can be garnered prior to an equity crowdfunding campaign. Using this approach, investors should be enticed by preferred terms (e.g., better pre-crowdraise valuation, preferred stock, etc.) with an understanding that the value of their stake will increase immediately upon the quickly following crowdfunding raise. In this respect, professional investor involvement in crowdfunding is analogous to institutional investor participation in an IPO in that both lend credibility to the deal and obtain preferred terms in exchange.

- Professional investors may also view successful crowdfunding as a validating event for a company. This would imply a post-crowdraise investment, but potentially investors could be encouraged to make an investment commitment to a company (at predetermined terms) but make that investment dependent on the success of the raise (based on dollars invested and/or new customers engaged) such that the company has two potential streams of investment. Professional investors invest only upon obtaining the validation they need to see, and the crowd investors are de-risked by the participation of professional investors in the company financing.

- One of the challenges in attracting professional investment is establishing a path to investment liquidity, and equity crowdfunding can create the momentum for an IPO. For example, a company might raise professional seed investment (at preferred terms for the investors) and then orchestrate a Reg A+ crowdraise, using some of the seed raise to fund the crowdfunding marketing campaign. Upon closing a successful campaign, the company might opt to leverage the momentum and public awareness of the campaign into an IPO, using the Reg A+ event as an IPO on-ramp and providing investment liquidity both for the seed investors as well as the Reg A+ investors.

- If a company foresees needing growing sums of capital investment as the company expands, then the momentum of a successful Reg CF crowdraise (limited to $1 million in investment) might be captured and followed quickly by a Reg A+ raise (with a $50 million limit) because the 12-month wait period is not applicable accross the two different regulatory paths. Conceivably, a company could move from professional investment to a Reg CF raise to a Reg A+ raise to an IPO all within 24 months.

Considerations for the Issuing Company

While LOHAS Capital assists its clients with navigating the JOBS Act and selecting an optimal approach, there a variety of elements that a company should consider before pursuing equity crowdfunding.

- When assessing the crowdfunding regulation preference, the two main considerations are whether the company is better suited for a raise open to unaccredited investors (e.g., a consumer products or services company) and how much the company hopes to raise (e.g., a Reg CF raise is limited to $1 million from unaccredited investors). While typically B2B companies are better suited for accredited investor capital raises, if a B2B company’s products/services are compelling and easily understood or if the company has a consumer brand awareness component to its marketing strategy (e.g., Intel Inside), then opening investment to unaccredited investors may be warranted.

- An unaccredited investor raise (i.e., Reg CF or Reg A+) can be hosted by a licensed portal while an accredited investor raise (i.e., Reg D, 506(c)) should be promoted by a licensed broker-dealer with experience orchestrating these types of raises. The ability of the broker-dealer in the 506(c) raise to tap its existing rolodex of investors (beyond what can be achieved during the marketing campaign or by the company itself) may be critical to the success of the raise.

- While Reg D, 506(b) is the most common path for accredited investment into private companies, the use of the 506(c) approach created under the JOBS Act is growing. Although 506(c) puts some (minor) additional obligations on investors, it allows the company and its broker-dealer to expand the investor pool through the marketing campaign, thereby broadening the company’s support ecosystem while potentially filling gaps in the investment offering.

- Simple common stock (with no voting rights) is the most typical form of investment offered during a JOBS Act capital raise. However, the Act allows for a variety of structures, including debt and even revenue-based financing, which may be appealing to investors by providing a predetermined ROI and not requiring a future equity liquidity event.

- While equity crowdfunding is the next evolution of rewards crowdfunding, there is still a role for rewards in an equity campaign (if a company sells consumer products or services). In fact, how a reward is inter-mixed with the equity investment offering may have a meaningful impact in determining the attractiveness of the equity offering to investors.

- If selling stock as part of the crowdfunding process, a valuation must be set for the company so investors know what they are buying. This is no different than if a company were selling an equity stake to professional investors. Of course, unlike a traditional equity raise, the investors will not be dictating that valuation, but the company should establish a valuation that reflects market norms while serving its short and long-term needs. For example, a company should not set a valuation so high such that it would either deter investment during the crowdraise or establish a valuation that will not be achievable (as an “up round”) in a subsequent investment by professional investors (if future investment is a possibility). Setting a company valuation for crowdfunding that is higher than a current open round may, however, encourage investors to participate prior to the crowdraise in order to garner the preferred terms and enjoy a quick boost in the value of the investors’ stake after the crowdfunding.

- If raising capital through an equity crowdfunding investment portal, a company must determine the minimum threshold and target investment goals for the raise. If the company does not raise at least the minimum threshold, then all funds invested will be returned to the investors. The investment target is the stated amount the company is seeking to raise and may or may not be final depending on whether the company allows the raise to be oversold. For example, a company pursuing a Reg CF raise may set a target of $500K but be open to raising more (within the limits set by Reg CF). Setting raise expectations low may be a good strategy due to the positive impression created by a crowdfunding event that is exceeding its goals (versus raising a similar amount with a higher goal and making the opposite impression to investors).

- If pursuing a Reg CF or A+ offering, selecting the licensed investment portal for the raise may be an important step in the process. Considerations include portal costs, services provided to raising companies, and success with similar company raises. Some portals also offer financial support to select companies in the form of advanced marketing campaign fees. This type of financial support may be critical to a company needing additional capital to invest in its equity crowdfunding marketing campaign, and if appropriate, LOHAS helps prepare its clients to obtain this type of assistance. If pursuing a 506(c) investment strategy, then a company will need to identify a broker-dealer to sponsor the raise. LOHAS works with its clients to select the optimal investment portal or broker-dealer to meet each company’s individual needs.

- A concern for companies contemplating a JOBS Act raise may be how to manage a potentially large number of new investors on the company’s cap table. Notably, the legal obligations are limited but do require ongoing communication with the investor pool, and the benefits of engaging large numbers of customers as investors may be enormous. Whether the goal of the crowdraise is to generate as many customer-investors as possible or not, LOHAS requires that every client utilize a post-raise investor relations communication service and recommends a specific low-cost solution well-suited to the task of communicating to crowdfunding investors while limited in the type of company financial performance information that is shared.

- Although there have been exceptions, generally rewards-based crowdfunding is geared towards raising a smaller amount of capital (typically $50,000 or less) than equity crowdfunding. However, if a company plans to pursue JOBS Act fundraising but has not yet built a customer following or brand awareness or truly tested the attraction of new products or services with the public, a rewards campaign can be a relatively low cost strategy for generating demand and proving market acceptance while at the same time gathering data on rewards campaign participants that can later be used in the equity crowdfunding campaign. LOHAS will work with companies to orchestrate a rewards campaign if they are pursuing that path as a precursor to a JOBS Act event.

LOHAS Capital Solution

While still in the early days of the JOBS Act, the data from the equity crowdfunding market is clear that without meaningful investment in a well-orchestrated marketing campaign, a company has little chance of achieving its fundraising goals. The idea that, by simply posting a new offering on an investment portal, individuals will flock to make an investment has quickly been proven false, and the vast majority of crowdfunding campaigns have failed while companies have wasted precious time and resources in the process. By the same token, the marketing approaches that worked well in low-dollar, rewards-based crowdfunding campaigns (e.g., catchy videos and websites) are not, by themselves, adequate to reach and engage a broader array of investors in a higher investment equity offering.

- LOHAS Capital is not a JOBS Act investment portal but rather a marketing technology and data intelligence company exclusively dedicated to optimizing the marketing campaigns of its crowdfunding clients. LOHAS has invested in the technology tools and know-how found in the marketing organizations of large companies and deploys those capabilities across multiple client campaigns. In fact, LOHAS is developing a marketing automation platform to expand further the scale and scope of the campaign optimization services offered, incorporating a collection of best in class technologies infused with proprietary algorithms matched to each client’s campaign needs.

- Beyond bringing some technological rigor to the crowdfunding campaign challenge, LOHAS is also developing an ever-increasing database of accredited and unaccredited investors who have demonstrated an interest in buying or investing in solutions with some beneficial social impact. Because many of the parties engaged by LOHAS during a crowdfunding campaign are driven by the social enterprise aspects of the issuing company’s solutions, subsequent LOHAS clients benefit from preceding LOHAS campaigns, and LOHAS’s database and knowledge-base of social conscious customers/investors grows with every crowdfunding campaign orchestrated.

- The goals of LOHAS’s marketing campaign efforts differ from client to client. For example, not only will fundraising targets vary but also some clients may value new customer generation more highly than fundraising, which may require modifying campaign strategy. Nonetheless, LOHAS follows a set process for every client engagement, beginning with a half-day campaign planning session that typically occurs 60 to 90 days prior to the commencement of the capital campaign going live and that culminates in a campaign plan, laying out LOHAS and client responsibilities, timelines, and budgets throughout the process and through the termination of campaign activities. While a company’s responsibilities in preparation of a crowdfunding campaign are not insignificant, LOHAS’s goal is to optimize clients’ campaigns while taking much of the substantial crowdfunding burden off of executives’ desks.

- Notably, LOHAS’s goals and process for equity crowdfunding open to unaccredited investors differs from those limited to accredited investors. When managing a marketing campaign for a Reg CF or Reg A+ crowdraise, the LOHAS goal (at least in part) is to drive prospective investors to the investment portal or online location hosting the offering so that investment transactions are consummated (or interest generated such that follow-on investor outreach can encourage a future transaction). With 506(c) campaigns on the other hand, LOHAS’s campaign efforts are focused on filling the funnel with new, prospective accredited investors for the company and/or broker-dealer, who should then filter through those parties to determine who is truly accredited and non-competitive and therefore, should obtain access to the company’s due diligence information. The investment transactions that follow will ultimately occur with the broker-dealer.

- LOHAS engages directly with client companies to manage their crowdfunding marketing campaigns using the LOHAS marketing platform and support services. While LOHAS shares market data and provides guidance on setting campaign marketing budgets, how much that is dedicated to a campaign is at the sole discretion of the client. Because it is not a licensed investment portal or broker-dealer, LOHAS does not and cannot accept fees based on the success of the crowdraise but rather is paid fees based on the client-established campaign marketing budget. Typically, the campaign budget (i.e., the fees paid to LOHAS) are spread out over the course of the campaign to reflect the time at which costs are incurred.

- LOHAS generally manages all aspects of the marketing campaigns of our clients, including orchestrating the production of creative content, directing the various preparations pre-campaign, and then orchestrating the digital inbound and outbound components throughout the campaign. However, some client companies may already have certain skill sets in-house or relationships with preferred partners (e.g., PR, videography, etc.) and LOHAS can structure the engagement to focus only on those areas of need to maximize cost-effectiveness.

- Once a crowdfunding campaign goes live, the LOHAS marketing platform and support services are designed to identify, reach, and engage target audiences in the crowdfunding effort. Beyond using predictive analytics, LOHAS applies machine learning technology and techniques to optimize performance throughout the campaign and provides ongoing reporting so that clients can readily understand how various campaign strategies are performing and adjustments that are being made.

- Because many LOHAS client companies are raising capital from professional investors in addition to the crowdfunding efforts, LOHAS is also developing a network of angels, venture capitalists, and family offices with an interest in health, sustainability, or social impact investing. While LOHAS is not in the business of brokering investments in client companies, LOHAS’s growing investor network is encouraged to participate in client offerings prior to, during, or following the equity crowdfunding campaigns.

LOHAS Client Profile

LOHAS Capital works primarily with growth-stage companies whose products or services benefit people or planet. LOHAS is dedicated to social impact ventures not only because the LOHAS team has a background in and commitment to these areas but also because of the high growth and positive investment trends in these markets, the lack of investment capital being offered to companies pursuing these paths, and the passionate customers and investors in this space (well suited to engagement through crowdfunding campaigns).

- While LOHAS focuses on growth-stage companies, what constitutes growth stage may be different depending on sector. For example, most LOHAS clients have real customer traction and/or have raised seed capital. However, how that is manifested may be different for a cleantech company (with product/service customers and revenue) versus a healthcare company (that may be raising capital to advance from one clinical trial stage to the next) versus a real estate development (that may have secured certain development rights but has not started construction). In fact, LOHAS also works with long-established companies that may have new product lines for which they are seeking investment but have no current customer traction.

- The success metrics for an unaccredited investor crowdraise (Reg CF or Reg A+) campaign may be different than for an accredited investor raise (Reg D, 506(c)). For example, a LOHAS client goal for a Reg CF campaign may be primarily to generate customer demand (and brand/solution awareness) and the campaign may be optimized for that purpose with fundraising a secondary priority. On the other hand, LOHAS’s goal for an accredited 506(c) campaign may be purely focused on generating “investor leads” for the company and broker-dealer to expand the pool of investor candidates while building brand/solution awareness and growing the company’s ecosystem of supporting customers, partners, and suppliers.

Equity Crowdfunding Process and Costs

JOBS Act fundraising is, at a minimum, a 5 to 6-month process and begins with a LOHAS campaign planning session. Given the amount of time required to execute a successful campaign, a company should plan its engagement timeline accordingly. The costs to consider before undertaking equity crowdfunding include:

- Legal and accounting costs – LOHAS has identified and partnered with low-cost providers of legal and accounting services experienced with specific JOBS Act areas. These costs vary widely depending on which title under the JOBS Act is being utilized, with Reg CF legal and accounting costs being relatively low (e.g., $10,000) while Reg A+ costs (that, for example, require a full financial audit) being higher (though, notably, still lower than typical IPO legal and accounting costs). These are all fees that must be paid before the equity crowdfunding process begins.

- Campaign marketing costs – this represents the investment a company plans to make in its equity crowdfunding campaign to build awareness and produce results during the process. The amount typically dedicated to a campaign marketing budget varies depending on the financial goals of the raise. Market data suggests, for example, that a company seeking to raise $1M through a Reg CF crowdraise should plan to spend 4% – 5% of that amount in the marketing campaign (i.e., $40K – $50K). Of course, if a company is seeking to raise $50M through a Reg A+ crowdraise, then dedicating 5% of that goal to the marketing budget may be far too high. Notably, as described above, this is a “2 for 1” investment in that a company is also generating solution/brand awareness (and demand) through the marketing efforts in addition to the fundraising aspect of the campaign. These are also typically costs that can be spread out over the course of the 5-month (or more) campaign process.

- Portal and broker-dealer fees – these are the fees paid by the issuing company to the licensed investment portal or broker-dealer that is hosting/sponsoring the raise and managing the investment transactions. These fees are typically a percentage of the capital raised and paid upon the conclusion of the raise, though some broker-dealers sponsoring a 506(c) raise may charge an up-front retainer and/or require an equity stake in the company as well. The percentage requested varies across portals and broker-dealers, with 5% of the raise being a common Reg CF portal fee. Notably, a Reg A+ raise can, in theory, be managed by the issuer and not require a portal’s support.

Running a Successful Crowdfunding Campaign

Ultimately, the success of equity crowdfunding is determined by the attractiveness of the offering, the issuing company, and its products or services. However, there are variety of factors that can greatly influence the results of a crowdfunding campaign.

- While a company may not legally be permitted to “sell securities” prior to a crowdraise “going live”, crowdfunding data shows that, in order to reach investment goals, it is important to raise at least 20% of the goal in the first 48 hours after the fundraising officially begins. Because the marketing campaign announcing a fundraising opportunity may not commence until the go-live date, the need for early investment implies a need for the company to obtain investment commitments prior to that date.

- These commitments may come, in part, from “friends of the firm”. This could mean friends and family of company owners or the company’s supporters, partners, suppliers, distributors, or key customers. An upcoming crowdraise may be used as a galvanizing event to encourage backers to demonstrate their commitment similar to how supporters of a political candidate might be asked to buy plates/tables at a campaign fundraising dinner.

- Sometimes professional investors may contribute in these early stages of a crowdraise. If a company were receiving investment prior to crowdfunding, the company may request that the investors withhold some of that investment until the crowdraise. For example, if a company were receiving $500K in equity investment from seed investors for 10% of the company prior to crowdfunding, then the company might ask its investors to retain $100K of the investment until the crowdraise but offer better terms on the remaining $400K investment such that the investors still receive a 10% company stake but are also assisting the company by “seeding” its crowdfunding.

- If the company pursuing equity crowdfunding is a consumer products or services company, then the importance to the campaign of existing customer data cannot be overstated. So capturing customer data in the normal course of business is critical. Current customers will serve as the foundation for the crowdfunding marketing campaign, with the goal of both converting them into investors and replicating their profiles as part of the marketing strategy. LOHAS focuses on expanding this customer base and deepening the relationship or, for earlier stage companies or older companies with new consumer offerings, helping build the customer foundation upon which the company (and its crowdfunding campaign) will grow.

- A JOBS Act fundraising event can be an optimal time to engage key market influencers in a company’s journey. Unlike typical fee-for-service advertising, during a crowdfunding campaign, a company has an opportunity to offer influencers a real stake in the company, and the influencer has a platform for directly impacting the company’s financial future. Targeted market influencers are already having a meaningful impact on crowdfunding campaigns, and LOHAS works with partners to help identify and connect appropriate influencers with clients, especially for consumer product and service companies.

- LOHAS engages client companies that are well-positioned for a successful equity crowdraise and that fit the LOHAS framework. Specifically, there are four characteristics of a LOHAS client:

- The (for-profit) company’s products or services should benefit people or planet. LOHAS typically works with health or sustainability or other social impact companies.

- The company is raising growth-stage capital. LOHAS does not typically work with early-stage startups but may support clients with their rewards-based crowdfunding campaigns as a means to generate customer demand and then leverage that customer base in an equity crowdfunding campaign.

- The company has the capacity to make a meaningful investment in its crowdfunding marketing campaign. Whether the marketing budget comes from company revenues, outside investment, a supporting crowdfunding portal, or a combination of those or other sources, a company’s investment in its marketing campaign is directly correlated to the success rate of the crowdraise.

- A company should have the ability or relationships to obtain investment commitments before the crowdfunding goes live. This pre-selling of the investment opportunity and achieving meaningful investments in the early stages of crowdfunding is critical not only to the ultimate success of the campaign but also of the performance of the marketing campaign activities (i.e., driving parties to an underperforming campaign site can be counterproductive).

JOBS Act Advantages for Professional Investors

Because it is the early days of the JOBS Act and equity crowdfunding is often still confused with rewards crowdfunding, many professional investors have not embraced JOBS Act financing. They may view crowdfunding as competitive or, worse, as a potential burden to the cap table. As the market evolves and more performance data becomes available, professional investors may find that crowdfunding can actually provide an attractive leverage point in a company’s financing strategy while also demonstrating market validation, reducing risk, and providing a path to an increased valuation or investment liquidity.

- Most companies pursuing equity crowdfunding view those funds as supplemental to professional investment. These companies are primarily seeking additional capital and/or targeting the benefits of engaging customers as investors in the company’s journey. By soliciting investment prior to crowdfunding, companies are offering professional investors preferred terms compared to those offered in the subsequent crowdraise and an immediate boost in the value of the investors’ stake.

- At a minimum, a JOBS Act campaign provides a unique opportunity to assess a company’s appeal to customers and investors. A company that has recently completed a successful equity crowdfunding campaign offers a clear sign of market validation to investors. They potentially come to the investment table with new capital and customers and a better and more informed market position than prior to crowdfunding.

- Notably, if professional investors see the value of market validation in crowdfunding but want to capture the preferred terms offered pre-crowdraise, then investors might offer to invest at pre-determined, preferred terms but only if certain customer or capital metrics are achieved during the subsequent crowdfunding. Similar to a charity fundraising scheme, these “matching funds” could be highlighted during the crowdraise to de-risk the investment for crowdfunding investors, with the company potentially setting the minimum investment threshold at the level required by the professional investors. Under this scenario, all parties benefit: the company receives two streams of investment (professional and crowdfunding), the professional investors make their investment (at preferred terms) only upon receiving the market validation they require, and the position of crowdfunding investors is de-risked due to the presence of professional investors in the deal.

- Reg A+ was designed by regulators to be an IPO on-ramp. This “online public offering” as a path to an “initial public offering” strategy is already being implemented in the marketplace with attractive results. LOHAS is working with client companies that are offering professional investors this path to liquidity from the on-set, laying out a plan of company financing that moves from professional investment to a Reg A+ raise (with the market campaign managed by LOHAS) to an IPO (with the investment banking firm already selected) and delivering investor liquidity in less than 24 months. Under this scenario, each investment stage builds capital and momentum for the next, and the financing strategy becomes a central tenant of the initial offering to professional investors.

- Whether following a pre-planned path to IPO or merely capturing preferred terms prior to a marketing validating crowdraise, professional investors who endorse or financially support crowdfunding recognize the power of their presence or investment in the company in delivering a successful crowdraise while not relying on other professionals or institutions to be the follow-on investors in the deal. Notably, by signaling their support of a company to influence the participation of crowdfunding investors (versus, for example, institutional investors), professional investors can maintain a controlling position in the company, thereby reducing the risk of having their position minimalized by subsequent institutional investors.

Meaning of “LOHAS”

“LOHAS” is a consumer market segmentation term that stands for “Lifestyles of Health and Sustainability” and refers to that segment of the population that aspires to a healthier and more environmentally friendly lifestyle and makes buying decisions accordingly. Many LOHAS Capital clients hold some appeal to the LOHAS market segment, which might engage as customers or investors; and LOHAS Capital recognizes that the data and trend lines showing large and growing consumer demand for and individual investor interest in healthy and sustainable solutions and companies have not been embraced by traditional financial markets and institutions.

- Based on various market studies, annual global sales to the LOHAS market segment already exceed $1 trillion and include a diverse set of product and service areas, including personal health and natural lifestyle consumer goods, clean energy and transportation solutions, cleantech products, green building solutions, and even eco-tourism. These consumers, also referred to as “aspirationals”, by some accounts now make up almost one-third of the global population and are one of the fastest growing buyer segments worldwide.

- The JOBS Act was intended to give a substantially broader array of individuals the opportunity to invest in private companies, and data suggests that some of the most under-represented investors (prior to the JOBS Act) have a particular interest in and appetite for sustainable and socially responsible investments. For example, according to a recent Morgan Stanley investor report, 71% of individual investors are interested in sustainability investing. Compared to the overall individual investor population, Millennial investors are nearly two times more likely to invest in companies that foster positive environmental outcomes. Female investors are nearly two times as likely as male investors to consider both rate of return and positive impact when making an investment. And 65% of individual investors expect sustainable and socially responsible investing to become more prevalent in the next 5 years. LOHAS Capital helps its clients tap into this pent-up investor demand.

Engage a Broader Audience in your Cause

LOHAS Capital delivers campaign intelligence for health, sustainability, and social impact ventures. Contact us to start developing your campaign today.