Media & Resources

Lending Our Voice

to the Conversation

The LOHAS team is very active in the impact investing, family office, and social impact entertainment communities (among others), and we regularly feature our published articles, interviews, podcasts, educational webinars, and partner productions as well as firm and other announcements relevant to our clients.

The Latest From LOHAS

Gender Lens as a Winning Strategy in Impact Investing

This article was originally published on GreenMoney Journal as part of their inaugural “Women and Investing” edition.You can view that article here. Within the impact investing community, the value of gender diversity as an investment evaluation screen is rarely...

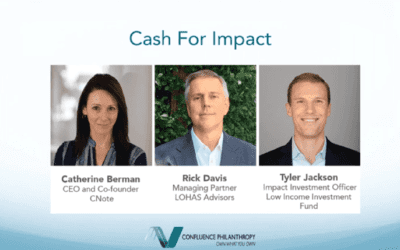

Rick Davis Featured in Confluence Philanthropy Webinar

Endowments portfolios have increasingly well-defined socially responsible investments guidelines across a range of asset classes. However, cash and other liquid allocations are often underutilized as a tool for positive social performance. Join CNote, an online...

Donor-Advised Funds will Drive Impact Investing

The LOHAS Advisors team was recently asked to share its expertise on Donor-Advised Funds and hot impact investing trends for a Refinitiv E-Book entitled Sustainable Finance and ESG: The 2020 Playbook. You can view the full E-Book here. Below is our contribution on...

Tami Kesselman Featured on Family Office World Podcast

In this episode of the insightful Family Office World Podcast, Tami Kesselman, Worldwide President of Harvard Alumni in Impact, and member of the Board of Directors for the Governance Committee at Harvard’s Kennedy School, articulately explains the explosive growth in...

Tami Kesselman Joins as a Partner of LOHAS Advisors

FOR IMMEDIATE RELEASE: February 4, 2020 Tami Kesselman Joins as a Partner of LOHAS Advisors The LOHAS team has a new impact investing pro! A Harvard-educated strategist and former Bain consultant, Tami Kesselman is a pioneer and thought leader on achieving concurrent...

Cash Deposits Can Make a Meaningful Impact on Communities

This article was originally published on GreenMoney Journal. You can view that article here. Because public and private equity investing garner most of the attention of impact investors, the liquid “cash” portion of the portfolio is often overlooked despite the...

Rick Davis Featured in Confluence Philanthropy Webinar

Endowments portfolios have increasingly well-defined socially responsible investments guidelines across a range of asset classes. However, cash and other liquid allocations are often underutilized as a tool for positive social performance. Join CNote, an online...

Donor-Advised Funds will Drive Impact Investing

The LOHAS Advisors team was recently asked to share its expertise on Donor-Advised Funds and hot impact investing trends for a Refinitiv E-Book entitled Sustainable Finance and ESG: The 2020 Playbook. You can view the full E-Book here. Below is our contribution on...

Tami Kesselman Featured on Family Office World Podcast

In this episode of the insightful Family Office World Podcast, Tami Kesselman, Worldwide President of Harvard Alumni in Impact, and member of the Board of Directors for the Governance Committee at Harvard’s Kennedy School, articulately explains the explosive growth in...

Tami Kesselman Joins as a Partner of LOHAS Advisors

FOR IMMEDIATE RELEASE: February 4, 2020 Tami Kesselman Joins as a Partner of LOHAS Advisors The LOHAS team has a new impact investing pro! A Harvard-educated strategist and former Bain consultant, Tami Kesselman is a pioneer and thought leader on achieving concurrent...

Cash Deposits Can Make a Meaningful Impact on Communities

This article was originally published on GreenMoney Journal. You can view that article here. Because public and private equity investing garner most of the attention of impact investors, the liquid “cash” portion of the portfolio is often overlooked despite the...